In contrast, employees who are discharged must be paid in full on the day of discharge. These obligations apply only to "wages." Thus, the key question on appeal was whether accrued, unused sick leave constituted "wages" under the Payment of Wages Law. Under the Payment of Wages Law, employees who resign must be paid in full on the next regular pay day.

#Sick pay trial#

After the trial court ruled for the plaintiff, his former employer appealed. Plaintiff then sued under the Payment of Wages Law because the employer had not paid him within the time frame required by the statute for final wage payments. Because of the lengthy grievance and arbitration proceedings, however, the employer did not make this payment until over a year after the plaintiff's last day of employment. Here, the employer initiated disciplinary proceedings against the plaintiff. One week later, the plaintiff applied for retirement. The employer ultimately terminated the plaintiff's employment for cause. As a result, the employer did not pay the plaintiff for his accrued, unused sick time based on its application of the policy.Īn arbitrator, however, overturned the employer's termination decision, finding that the employee retired before he was terminated. In light of that decision, the employer paid the plaintiff the full value of his accrued, unused sick leave (amounting to $46,755.41).

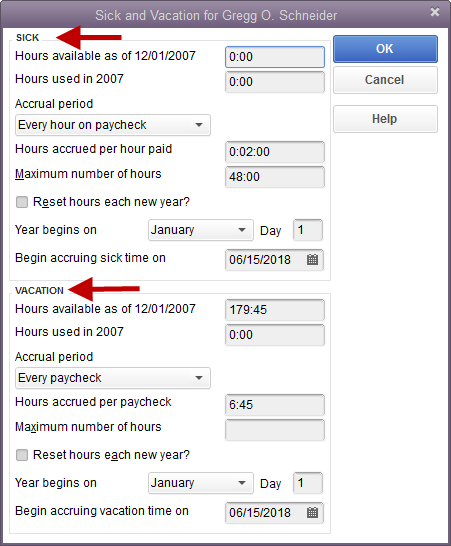

The policy further provided for no payment of accrued, unused sick pay to employees discharged for cause. Massachusetts Port Authority arose out of a fairly unusual sick leave policy. In this case, the employer's sick leave policy provided that, upon termination of employment, eligible employees receive payment for a percentage of the value of their accrued, unused sick time. Under the policy, the percentage would vary depending on the employee's tenure, i.e., employees who were employed for a longer period of time, or who remained employed until retirement or death, received a greater percentage of their unused sick time. As a result, employers are not liable under the Payment of Wages Law if they choose not to pay out accrued, unused sick pay to employees upon termination of employment. 29, the Massachusetts Supreme Judicial Court held that sick pay does not constitute wages under the Massachusetts Payment of Wages Law, M.G.L. Paid Leave Options Chart provides an overview of paid leave laws that may cover California workers affected by COVID-19 including laws on paid family leave, paid sick leave and COVID-19 Supplemental Paid Sick Leave.On Jan.Side by Side Comparison of Paid Leave Options Read more about workers' compensation for employers and workers' compensation for employees. Employers with one or more employees must maintain a valid workers' compensation insurance policy that pays for benefits for workers to recover from work-related injuries and illnesses.However, if an employer does have an paid vacation agreement, then certain restrictions are placed on the employer for fulling their obligation to provide vacation pay. There is no legal requirement in California that an employer provide either paid or unpaid vacation time.A similar SPSL law for 2022 was in effect until December 31, 2022. Supplemental Paid Sick Leave for COVID-19 is a new law from 2021 that required employers to provide additional paid time off for certain COVID-19 reasons. Supplemental Paid Sick Leave for COVID-19 (SPSL) Read more about this: Permanent Paid Sick Leave law that took effect in 2015. Employees under an accrual plan must earn at least one hour of paid sick leave for each 30 hours of work. Employers can choose to have a PSL policy that provides all of the hours at one time, or the policy can require employees to earn the paid sick leave hours in an accrual plan. To care for a family member who is ill or needs medical diagnosis, treatment, or preventative careĮmployers can choose to provide more PSL hours or days off.To seek medical diagnosis, treatment, or preventative care.

Recover from physical/mental illness or injury.Complete a 90-day employment period before taking any paid sick leave.Work for the same employer for at least 30 days within a year in California, and.This includes full-time, part-time and temporary workers who meet these qualifications: Paid Sick Leave (PSL) is a permanent law in California that requires employers to provide at least 24 hours or three days off each year to most workers. Read about the different types of Paid Sick Leave below. In California, most workers earn Paid Sick Leave to take time off work to care for themself or a family member.

0 kommentar(er)

0 kommentar(er)